Learn Forex Trading Step by Step

Forex trading can seem complicated at first, but with the right guidance and resources, anyone can learn the ropes. Whether you’re a complete newcomer or have a bit of experience, understanding the fundamentals is crucial. This guide will walk you through the essential steps of learning Forex trading, using both theoretical knowledge and practical examples. If you’re looking for reliable brokers to get started, check out the learn forex trading step by step Best Vietnamese Brokers to ensure a smooth trading experience.

1. Understanding Forex Trading

Forex, or foreign exchange, is the world’s largest financial market where currencies are traded. The Forex market is open 24 hours a day, five days a week, allowing traders from all corners of the globe to participate. In Forex trading, you buy one currency while simultaneously selling another. The goal is to predict whether the exchange rate between the two currencies will rise or fall.

2. Key Terminology

Before diving into trading, familiarize yourself with some key terminology:

- Currency Pair: Represents the exchange rate between two currencies. For example, EUR/USD is the Euro against the US Dollar.

- Pip: The smallest price increment in Forex trading, usually the fourth decimal place.

- Leverage: A tool that allows traders to control larger positions with a smaller amount of capital.

- Spread: The difference between the buying and selling price of a currency pair.

3. Choosing a Trading Style

Your trading style influences your strategy and overall approach to the market. Here are some common trading styles:

- Scalping: Involves making numerous trades throughout the day to profit from small price movements.

- Day Trading: A strategy where positions are opened and closed within the same trading day.

- Swing Trading: A medium-term approach that involves holding positions for several days or weeks.

- Position Trading: Long-term trading based on fundamental analysis, where trades are held for months or years.

4. Developing a Trading Plan

A solid trading plan includes your goals, risk tolerance, trading strategy, and evaluation criteria. Here’s how to create one:

- Define Your Goals: Determine what you want to achieve through trading, whether it’s generating an income, saving for retirement, or simply learning a new skill.

- Assess Your Risk Tolerance: Understand how much risk you are willing to take on each trade, and adjust your position sizes accordingly.

- Choose a Trading Strategy: Decide on the strategy you’ll use based on your preferred trading style and market analysis techniques.

- Establish Evaluation Metrics: Set criteria to evaluate your trading performance periodically. This could include win/loss ratios, average profit/loss per trade, and adherence to your trading plan.

5. Technical and Fundamental Analysis

To succeed in Forex trading, you’ll need to employ both technical and fundamental analysis:

Technical Analysis

This involves analyzing historical price movements to forecast future trends. Common tools and indicators include:

- Moving Averages: Helps identify the trend direction over a specific period.

- Relative Strength Index (RSI): Measures the speed and change of price movements, indicating overbought or oversold conditions.

- Bollinger Bands: A volatility indicator that shows how far prices deviate from a moving average.

Fundamental Analysis

This approach focuses on the economic indicators, news releases, and geopolitical factors that impact currency prices. Keep an eye on:

- Interest rates set by central banks

- Employment data and economic growth indicators

- Political stability and economic performance of countries

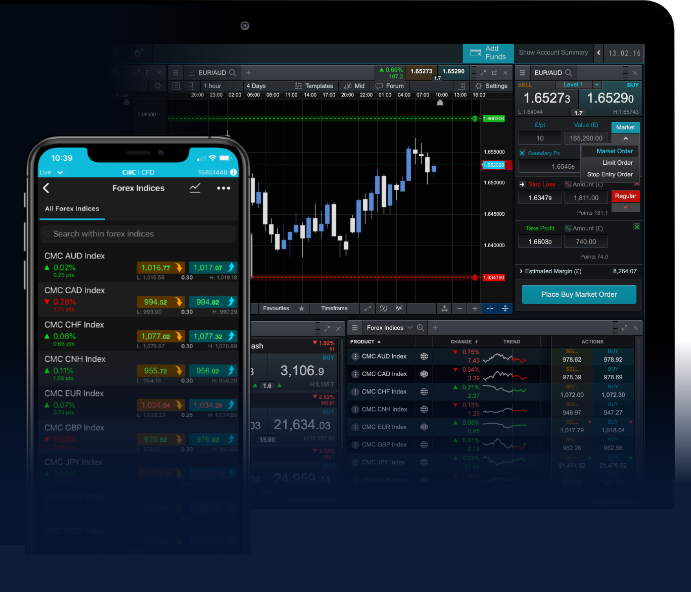

6. Practice with a Demo Account

Before risking real money, it’s wise to practice your trading strategies in a risk-free environment. Most brokers offer demo accounts that allow you to trade with virtual funds while gaining practical experience. This is an excellent way to refine your skills and become comfortable with your chosen trading platform.

7. Opening a Live Account

Once you feel confident in your trading abilities, it’s time to open a live account. Here are the steps to follow:

- Choose a Broker: Select a reputable Forex broker that aligns with your trading needs.

- Complete the Registration: Provide the required information and legal documentation to open your trading account.

- Fund Your Account: Deposit money into your trading account. Make sure to use the payment method that’s convenient for you.

- Start Trading: Begin placing trades based on your strategy, keeping your risk management practices in mind.

8. Managing Risk

Risk management is crucial in Forex trading. Here are some techniques to mitigate risk:

- Use Stop-Loss Orders: Set parameters to automatically close a trade at a specific loss level.

- Limit Your Leverage: While leverage can amplify your profits, it can also lead to significant losses.

- Diversify Your Portfolio: Avoid putting all your funds into a single trade or currency pair.

9. Continuous Learning

The Forex market is constantly evolving, and successful traders often invest time in continuous learning. Stay updated with market news, consider taking advanced trading courses, and engage with trading communities to share insights and strategies.

10. Conclusion

Learning Forex trading is a journey that requires time, practice, and patience. By following the steps outlined in this guide, you can build a solid foundation in Forex trading and develop the skills needed to navigate the market confidently. Remember, successful trading is not just about making profits, but also about understanding the risks and continuously improving your approach.